Over the last few years, unprecedented levels of economic upheaval have impacted many companies. Businesses have faced fundamental uncertainty from pandemics, rapid tech-driven disruption and shifts in consumer patterns.

Having a well thought out forecast that factors in multiple scenarios and trends is key to both surviving and thriving during global change. Regular financial forecasting provides a financial roadmap that not only can help maintain stability and adequate funds, but can also help management increase revenue and glean insights that show whether the business strategy is optimal. With these insights, leaders can then make the best decisions to reach growth goals.

Financial forecasting with the right inputs lays the groundwork for strategic planning

Building a forecast involves both science and creativity. This financial roadmap uses historic trends and industry data, but it also requires expertise to make the right assumptions and assess the probability of future performance scenarios. Thorough financial forecasting can help businesses position themselves for future growth opportunities.

Consider the retail sector: Many finance directors likely incorporated macroeconomic projections into their forecasts over the last several years in order to make forward-looking investment decisions around omnichannel and online capabilities. As online retail sales increased by a massive 44% in the U.S. in 2020 (compared to 15.1% in 2019), some companies that proactively invested in technology, distribution centers and buy online, pickup in stores (BOPIS) offerings have seen triple-digit gains in online sales.

From 2021–2025, global e-commerce revenue is forecasted to increase by a compound annual growth rate (CAGR) of 6.3%. This projection, in addition to business-specific data and inputs, can be factored into future investment scenarios. Leaders can then make informed decisions around funding omnichannel infrastructure with the aim of driving market share gains and improving customer loyalty.

During times of market volatility, it is useful to build out three to five probable scenarios that incorporate relevant opportunities and risks. Use of qualitative insights based on historical data and future predictions combined with inputs based macroeconomic, social and technological factors can provide depth to your financial forecast, giving you a competitive advantage in your ability grow and make changes as needed.

Key considerations for creating a strong forecast

Forecasting is important because it proactively lays out a plan for businesses so that when things turn out differently than expected, as they often do, management can appropriately react and pivot.

We have seen how many companies in the retail sector have had to make rapid reassessments of their businesses over the last several years. They have contended with everything from rising competition from e-commerce giants like Amazon to forced store closures and lower foot traffic due to the COVID-19 pandemic. To create a solid financial forecast, retail CFOs should take note of two important considerations:

1. Review cash flow needs

Even companies with strong balance sheets need to stay nimble and prepared. When discretionary retailers saw their sales take a sharp dive because of forced store closures in 2020, many had to shore up financing and ensure there was enough cash to get through the sudden, unexpected downturn.

For example, Gap had to continue to pay employees and for real estate even though it was forced in March 2020 to close its physical stores in North America and Europe for an extended period. This put a squeeze on its balance sheet, forcing it to defer the first-quarter dividend and draw down $500 million on its credit line. The company also deferred rent payments in North America.

Retail companies can prepare for situations like this by using a forecast to plan for how they could ride out unexpected downturns. Executives may choose to shore up their future liquidity profiles and cash balances for different potential scenarios. This could mean proactively refinancing loans or speaking with lenders to assess options.

While there are manageable solutions for navigating unexpected changes, it can be challenging to handle these jolts to a P&L and cash flow. It is much easier to pivot and reassess current strategies when you have prepared forecasts with multiple scenario analyses, including worst-case scenarios such as disruptions in supply chains or changes in consumer behavior. Detailed forecasting also provides management the insights they need to look long-term and plan for future growth, even during ongoing uncertainty.

2. Prepare for changes in demand

Many retailers had to manage sharp changes in demand during 2020. Grocery stores and other businesses focused on consumer essentials saw sharp spikes in demand as people stocked up their pantries. However, some also had to deal with supply shortages due to disruptions in the supply chain and higher than projected demand.

Going forward, essential businesses and discretionary retailers could benefit from including scenarios in their forecasts that incorporate higher than average increases in demand for certain goods. This could help them realize growth and strong performance by investing in the right merchandise or establishing the right distribution channels for important selling periods like the holiday season.

On the other hand, mall retailers have seen demand shrink from continued declines in foot traffic and competition with e-commerce over the last few years. These changes show the importance of focusing on multiple demand scenarios in the P&L portion of forecasts so strategies and plans can be updated quickly if these inputs change. These forecast insights can help give management a heads-up on any actions needed, in turn differentiating resilient businesses from those that cannot quickly pivot and adapt.

The importance of forecasting regularly

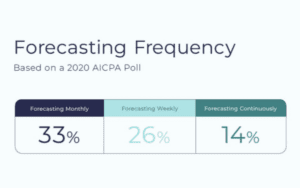

Even with a thorough forecast, it’s a good idea to keep a close eye on your financial models and reassess them on a monthly or bi-monthly basis when new data appears or old assumptions change. According to a 2020 poll conducted by the Association of International Certified Professional Accountants (AICPA), 33% of companies were forecasting on a monthly basis, 26% weekly, and 14% continuously. Especially during times of volatility, regular forecasting enables timely, actionable guidance to help you achieve your business targets and plan for the future.

What are the benefits of disciplined forecasting?

- A well-constructed forecast that incorporates the right inputs across multiple scenarios will guide you to make the best strategic decisions for growth, investment opportunities and market share gains.

- By creating a forecast that includes multiple revenue growth scenarios that factor in higher demand in the athleisure market, which is projected to increase at a 8% CAGR globally from 2020 through 2025, an apparel retailer may be guided to focus investments on marketing efforts and areas of expansion that could have the largest impact on its top and bottom line.

- You can save significant amounts of money. A study from the Institute of Business Forecasting & Planning of 15 U.S. companies showed that even a 1% improvement in accuracy saved $1.5 million for a company with $50 million in annual revenue.You will be better prepared to act quickly and decisively when unexpected changes occur. Your forecast will help ensure there is enough cash and liquid investments to get through any downturns. This can point you to proactive discussions on shoring up the balance sheet or renegotiating contracts.

Stay on top of financial forecasting to drive growth

Your business should be regularly building and monitoring a forecast, redefining your plans and outlook based on forecast insights, and executing accordingly. At Paro, we leverage our proprietary AI technology to build flexible, focused teams of remote experts that help companies solve problems and drive growth. Our laser focus on finance allows us to quickly identify experts across the U.S. with the right mix of skills, credentials, and experience to achieve each company’s specific goals. Request a financial forecast consultation and get one step closer to gaining the financial forecasting expertise your business needs.