Nobody likes taxes. Am I right?

Tax time usually means more work, more unintelligible jargon, and more confusion for you and your growing business. Our goal in this article is to turn this time of the year into a time where you can leverage existing tax laws to the best benefit of your business.

Today we will talk about special depreciation rules and how to write off asset purchases to decrease your tax liability. Let’s start with the obvious first question: What is depreciation?

Depreciation 101

When a business purchases a piece of equipment, software, or building, it sees a benefit from that asset for more than one year, hence why the asset gets depreciated over time. However, one specific tax rule called Section 179 Depreciation allows businesses to write off the entire cost (up to $500,000) of new business equipment/software/other assets at once as long as the asset meets certain characteristics, instead of depreciating the asset over time. The government does this to encourage business owners to reinvest in their businesses, thus stimulating the economy.

How does writing my assets off at once help my business?

Say your company had a really great year and made a lot of profit. You could either pay the full amount of taxes on your revenue (ouch)… or you could purchase new equipment before the end of the year and reduce your tax liability by the amount of the purchase.

Let’s pretend you run a t-shirt printing company that sold a record $1,000,000 of t-shirts last year and made $500,000 in profit. You could either pay the full taxes on your net income or reduce the amount of what you owe by purchasing a brand new t-shirt printing machine for $100,000. By purchasing the new piece of equipment, you have reduced your tax liability by $100,000 and will only be taxed on $400,000.

TIP: Be sure that if you make a purchase that the asset is placed in service before year end. If your company purchased an asset on 12/15/21, but it didn’t get delivered and placed in service until 1/1/21, the asset will need to be used on the 2022 tax return, not 2021.

Important limitations of writing off your assets all at once

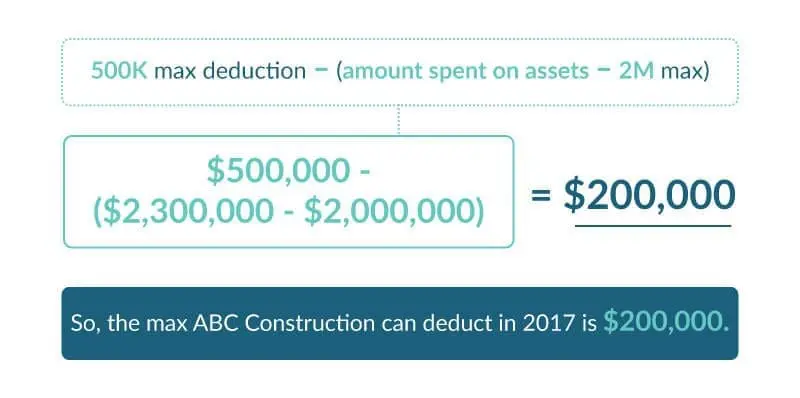

There are some limitations to this deduction, however. If a business purchases over $2,000,000 of assets in a given year, the 179 deduction is “phased out” (reduced) dollar for dollar for every dollar above $2,000,00 that a company spends on assets for a given year (fully phasing out at $2,500,000).

Essentially, phasing out means that any additional dollar spent on purchasing assets for your company that exceeds that 2M threshold reduces the amount of the 500K maximum deduction you can take by the same dollar amount. So, if your company buys $2,000,001 in assets in a given year, your maximum 179 deduction is limited to $499,999. If your company buys $2,100,000, your deduction is limited to $400,000, and so on and so forth.

For example: ABC Construction purchases $2,300,000 worth of assets in 2017. Come tax time, if the company decides to utilize the 179 deduction, it will be limited to $200,000 calculated as follows:

Additional deductions your business can take

In addition to this 179 deduction, if assets are not fully depreciated, the residual value of the asset can be depreciated on top of the 179 deduction.

Using the same example from above, let’s assume that all the assets purchased had a 5-year useful life and were placed in service on 1/1/2017. ABC company would get the $200,000 179 depreciation PLUS an additional depreciation deduction based on what was left over:

ABC company can deduct an additional $840,000. So, the total write off it can take in year 1 is $1,040,000:

Keep in mind that these amounts are assuming the assets were placed in service on January 1. The depreciation schedule will change based on the date.

TIP: The 179 deduction can be used on the purchase of both on new and used assets. Used equipment qualifies, so let that factor into your decision when thinking about asset purchases.

How investing in your business decreases your tax liability

Let’s take a look at an example of the kind of savings a company can expect to see from utilizing this tax deduction: XYZ Laser Tattoo Removal is looking to expand and add a couple of new technicians, as well as a new laser. The total cost of the equipment is $200,000, but the company’s CFO knows that if they factor in the tax savings resulting from utilizing the 179 deduction, the true cost of the equipment would be $130,000 calculated as follows:

Just from purchasing new (or used equipment) at the end of the year, XYZ Laser Tattoo Removal was able to recognize savings of $70,000 on its taxes.

When will a company not be able to use this type of write off?

In addition to the phase out mentioned above, if your company already had a big loss for the year, you cannot utilize the 179 deduction to bring your company into a greater loss. Additionally, you can only utilize this deduction up until it brings your company to $0 income for the year.

For example, say your company had $100,000 of taxable income for the year and you purchased $150,000 worth of new equipment this year. Your company’s 179 deduction is limited to $100,000, because any more will put your company in a loss for the year

Where can I go for more information?

This is NOT a comprehensive review of all things depreciation. This topic is far beyond the scope of this article. If you are looking for more detail on the specifics of depreciating assets, here is a link to the IRS publication on the topic. Or, talk to your trusted tax advisor. Don’t have a trusted tax advisor? Talk to one of Paro’s finance experts.